Creating multiple streams of income is a powerful strategy for achieving financial stability and independence. This document outlines various methods and approaches to diversify your income sources, ensuring that you are not solely reliant on a single paycheck. By exploring different avenues, you can enhance your financial security and potentially increase your wealth over time.

Understanding Multiple Streams of Income

Multiple streams of income refer to the various ways you can earn money beyond your primary job. This concept is essential for building wealth and protecting yourself against economic downturns or job loss. By diversifying your income sources, you can create a more resilient financial foundation.

Types of Income Streams

- Active Income: This is the income you earn from your job or business where you actively work for money. Examples include salaries, wages, and freelance work.

- Passive Income: This type of income requires little to no effort to maintain. Examples include rental income, dividends from investments, and royalties from creative works.

- Portfolio Income: This income comes from investments in stocks, bonds, and other financial assets. It can include interest, dividends, and capital gains.

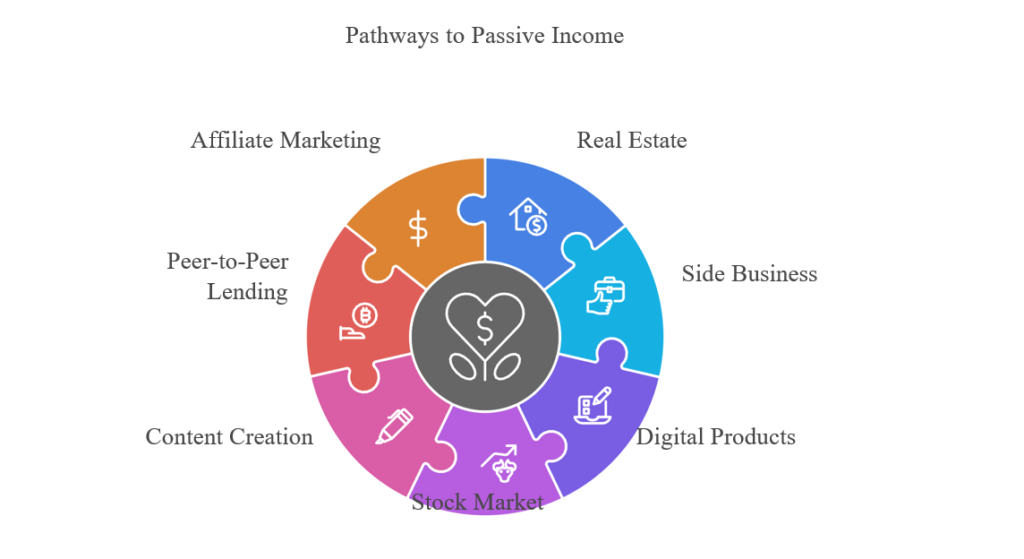

Strategies for Creating Multiple Income Streams

1. Invest in Real Estate

Real estate can be a lucrative source of passive income. Consider purchasing rental properties, investing in real estate investment trusts (REITs), or flipping houses for profit.

2. Start a Side Business

Identify a skill or passion that you can monetize. This could be anything from consulting, tutoring, or selling handmade products online. A side business can provide additional income while allowing you to pursue your interests.

3. Create Digital Products

Leverage your expertise by creating digital products such as e-books, online courses, or stock photography. Once created, these products can generate passive income with minimal ongoing effort.

4. Invest in the Stock Market

Investing in stocks, mutual funds, or ETFs can yield dividends and capital gains. Educate yourself on the stock market and consider a diversified investment strategy to mitigate risks.

5. Build a Blog or YouTube Channel

If you enjoy creating content, consider starting a blog or YouTube channel. With time and effort, you can monetize your platform through ads, sponsorships, and affiliate marketing.

6. Peer-to-Peer Lending

Consider participating in peer-to-peer lending platforms where you can lend money to individuals or small businesses in exchange for interest payments.

7. Affiliate Marketing

Promote products or services through affiliate marketing. You earn a commission for every sale made through your referral link, making it a great way to generate passive income.

Conclusion

Creating multiple streams of income is a strategic approach to financial security and wealth building. By exploring various avenues such as real estate, side businesses, digital products, and investments, you can diversify your income sources and reduce financial risk. Start small, stay consistent, and watch your income grow over time.