In an era where inflation can significantly erode purchasing power, it is crucial to adopt strategies that can help safeguard your finances. This document outlines five smart ways to protect your financial health from the adverse effects of inflation in 2025. By implementing these strategies, you can enhance your financial resilience and ensure that your savings and investments maintain their value over time.

1. Diversify Your Investment Portfolio

One of the most effective ways to combat inflation is to diversify your investment portfolio. By spreading your investments across various asset classes—such as stocks, bonds, real estate, and commodities—you can reduce risk and increase the potential for returns that outpace inflation. Consider including inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), which adjust with inflation and can provide a reliable income stream.

2. Invest in Real Assets

Real assets, such as real estate and commodities, tend to retain their value during inflationary periods. Investing in physical assets can provide a hedge against inflation, as their prices often rise in tandem with the cost of living. Consider purchasing rental properties or investing in real estate investment trusts (REITs) to benefit from potential appreciation and rental income.

3. Build an Emergency Fund

Having a robust emergency fund is essential for financial stability, especially during inflationary times. Aim to save at least three to six months’ worth of living expenses in a high-yield savings account. This fund will provide a financial cushion in case of unexpected expenses or job loss, allowing you to avoid dipping into investments that may be negatively impacted by inflation.

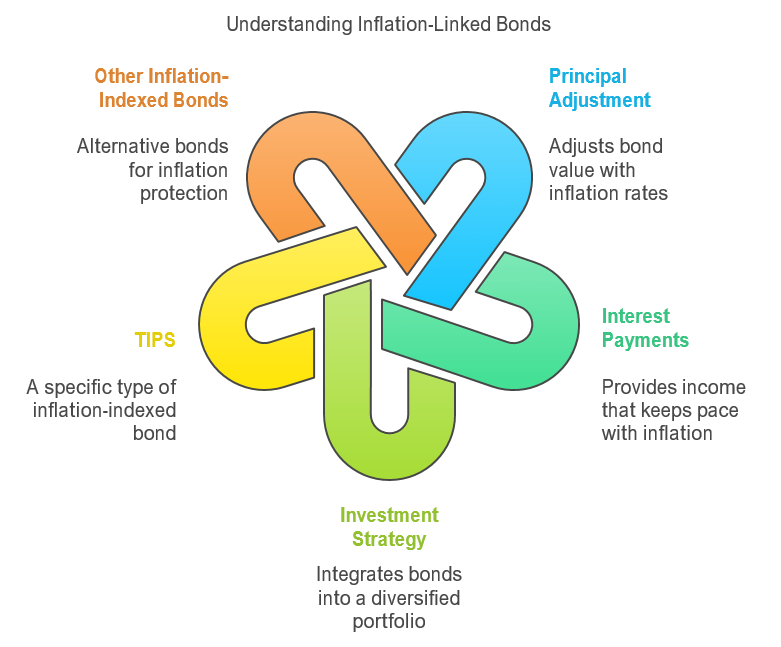

4. Consider Inflation-Linked Bonds

Inflation-linked bonds are designed to protect investors from inflation by adjusting the principal and interest payments based on inflation rates. These bonds can be a valuable addition to your investment strategy, as they provide a steady income stream that keeps pace with rising prices. Research options such as TIPS or other inflation-indexed bonds to incorporate into your portfolio.

5. Review and Adjust Your Budget

Regularly reviewing and adjusting your budget is crucial in an inflationary environment. Keep track of your expenses and identify areas where you can cut back or make adjustments. This proactive approach will help you manage your finances more effectively and ensure that you are prepared for rising costs. Additionally, consider negotiating for raises or seeking additional income sources to offset the impact of inflation on your budget.

Conclusion

By implementing these five strategies, you can effectively shield your finances from inflation in 2025. Staying informed and proactive about your financial health will empower you to navigate the challenges posed by rising prices and maintain your purchasing power.